We published our Q3 2024 results on November 6, 2024

Find all info here

Investor Relations

Our Q4/FY numbers in a nutshell

with CEO Frans Muller & CFO Natalie Knight

Press release

Ahold Delhaize ends 2021 with accelerating Q4 sales; 2022 outlook forecasts solid margins and continued strong free cash flow generation

- On a two-year comparable sales growth basis**, Q4 comparable sales excluding gas increased 16.0% in the U.S. and 11.6% in Europe, accelerating versus Q3 in both segments.

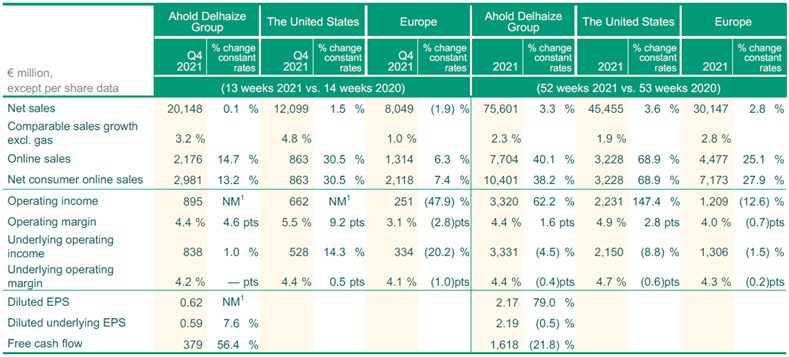

- Q4 Group net sales were €20.1 billion, up 0.1% at constant exchange rates compared to Q4 of 2020, which contained a 53rd week. Excluding last year's 53rd week, Q4 net sales grew by 6.7% at constant rates. Full year 2021 Group net sales of €75.6 billion were up 3.3% over 2020 at constant exchange rates, and up 5.0% on a comparable 52-week basis.

- In Q4, net consumer online sales grew 13.2% at constant exchange rates. 2021 net consumer online sales grew 38.2% at constant exchange rates.

- In 2021, we invested €364 million in COVID-19 care, including a commitment of €20 million in additional charitable donations spread evenly between the U.S. and Europe. In total, our brands contributed over €199 million in monetary value to charitable initiatives in 2021.

- Q4 underlying operating margin was 4.2%, flat year-over-year at constant exchange rates. 2021 underlying operating margin was 4.4%.

- Q4 diluted underlying EPS was €0.59, an increase of 7.6% at constant currency rates versus the prior year. 2021 diluted underlying EPS was €2.19, down 3.4% or down 0.5% at constant currency rates. Q4 IFRS-reported operating income was €895 million; Q4 IFRS-reported diluted EPS was €0.62, and 2021 IFRS-reported diluted EPS was €2.17.

- Strong 2021 free cash flow generation of €2.2 billion was used to pay a $190 million (~€170 million) pension liability in the U.S. following 2020 U.S. MEP withdrawals, ahead of schedule, and fund the Company's decision to pay approximately €380 million related to a disputed tax claim, resulting in €1.6 billion reported free cash flow for 2021.

- We propose a cash dividend of €0.95 for fiscal 2021, which is a 5.6% increase compared to 2020.

- 2022 outlook: underlying operating margin to be at least 4%; underlying EPS to decline by low- to mid-single-digits vs. 2021; free cash flow of approximately €1.7 billion; net capital expenditures of €2.5 billion.

** Two-year comparable sales growth is a stack of the comparable sales growth excluding gasoline in the current year period added to the comparable sales growth excluding gasoline in the prior year period. This measure may be helpful in improving the understanding of trends in periods that are affected by variations in prior-year growth rates.

Zaandam, the Netherlands, February 16, 2022 – Ahold Delhaize, one of the world’s largest food retail groups and a leader in both supermarkets and e-commerce, reports fourth quarter results today.

The summary report for the fourth quarter 2021 can be viewed and downloaded at www.aholddelhaize.com.

Summary of key financial data

- Not meaningful, as Q4 2020 Group operating income at constant rates and operating income in the U.S. were losses, and diluted EPS was negative in Q4 2020.

Comments from Frans Muller, President and CEO of Ahold Delhaize

"We ended 2021 on a strong note, with positive Group Q4 comparable sales momentum and stable Group margins, positioning us for a strong start to the next phase of our Leading Together strategy announced last November. Looking back on the past year, I am most proud of how associates brought our values to life in the way they responded to ongoing developments associated with COVID-19 and natural disasters throughout our brands' markets, including major floods in Belgium, tornadoes in the Czech Republic, fires in Greece and Hurricane Ida in the U.S. Through it all, associates rose to the challenge to care for customers and communities. As a result, we enter 2022 with deeper relationships and trust across our brands' markets and stronger market shares to build upon.

"For the full year, our COVID-19 care investments totaled €364 million, which included our commitment of €20 million in additional 2021 charitable donations spread evenly between the U.S. and Europe. In total, our brands, combined, contributed over €199 million in monetary value to charitable initiatives across the globe in 2021. The pandemic has shown us the importance of maintaining food and product supplies to local communities – a vital role that we remain focused on fulfilling, together with our brands and suppliers.

"Our financial results in 2021 significantly exceeded our original expectations, with positive full-year comparable sales growth and stable 52-week comparable underlying earnings compared to record results in 2020. This was despite supply chain challenges, increasing inflationary pressures and the dilutive effect as we continue to rapidly expand our omnichannel proposition. Our investment in our omnichannel platform once again proved its worth during 2021, with Group net consumer online sales growing by more than 38% compared to 2020, representing a two-year stack growth of more than 105%. This positively impacted our 2021 Group net sales, which, at €75.6 billion, remained elevated – up 3.3% versus 2020 at constant rates.

"In Q4, we maintained the momentum built throughout 2021, and produced Group two-year comparable sales stack growth of 14.2%, accelerating from the 12.2% growth achieved during Q3.

"In the Netherlands, we successfully converted all 38 stores acquired from DEEN to the Albert Heijn banner during the quarter. The converted stores are performing well and contributing to Albert Heijn's strong market share gains, which were leading among Dutch food retailers during 2021. In 2022, the brand is committed to building on its recent expansion into new channels, with its Albert Heijn to go format scheduled to open at an additional 18 BP fueling stations, following the introduction at 86 locations in late 2021. Its new online subscription program – Albert Heijn Premium – launched in Q4 and is also off to a strong start, with well over 300,000 subscribers through February.

"To advance its omnichannel offerings in the U.S., Giant Food launched online marketplace solution Ship2me, initially offering around 40,000 additional general merchandise and food items. Our U.S. brands also added new click-and-collect locations in Q4, for a total addition of 270 in 2021.

"As we enter 2022, we will accelerate our omnichannel investments to capture the incremental growth opportunities we see over the horizon, enabled by our platform. Improving omnichannel productivity also remains a very high priority as part of the commitment we announced at our November Investor Day to reach fully allocated profitability in Group e-commerce operations by 2025. It comes as the global COVID-19 pandemic continues to highlight the importance of strong omnichannel food retail operations that offer consumers a variety of shopping options, including robust online offerings.

"In this respect, we are proud of The GIANT Company's new e-commerce fulfillment center that opened in the Philadelphia market in Q4. It is supporting our growth and productivity ambitions for 2022 and beyond. We continue to invest across our entire distribution network and build new digital capabilities.

"This will be particularly visible at bol.com, where we will more than double investments in 2022 as we begin a phase of significant investment in the brand. As we announced at Investor Day, we increased Group capex guidance to ~3.5% of sales for the period 2022 until 2025. Excluding bol.com, our grocery business capex guidance will continue at prior averages ~3%. These additional investments will ensure momentum at bol.com remains strong, and will be funded, amongst other means, by the strong projected free cash flow generation of the grocery business of at least €7 billion for the period 2022-2025.

"In 2021, despite decreasing tailwinds from the COVID-19 pandemic, bol.com net sales increased 21% to €2.8 billion, with net consumer online sales growing 27% to €5.5 billion, fueled by our growing merchant partner network, which now stands at around 49,000. Profitability was also strong, with underlying EBITDA of €166 million keeping pace with the prior year. IFRS-reported operating income was €95 million. The investments we plan in 2022 will kick start a multi-year phase of investment to put the infrastructure in place to match the volume growth we expect in the coming years and build out highly accretive service capabilities in advertising and logistics. We are excited about this chapter in bol.com's evolution and continue to progress on our plans to get bol.com ready for a sub-IPO during the second half of 2022.

"On a final note, during Q4, we were pleased to have earned an upgrade to our MSCI ESG ranking to 'AA' from our previous 'A' ranking. We also maintained our standing as a leader in the Dow Jones Sustainability Index. Our score of 83 out of 100 was well above the industry average 26 points and placed us highest among food retailers in Europe and the U.S.. We expressed our intention to make continued progress on the ESG front through our decision in Q4 to pull forward our commitment to reach net-zero carbon emissions across our brands by no later than 2040. And we will actively apply this lens as we invest in our future. For example, at bol.com, we recently reached an agreement to acquire a majority stake in Cycloon, a green and social delivery expert, which will help support bol.com's growth ambitions and sustainability efforts. As we double down on our efforts to support the transformation of our industry into a healthy and sustainable ecosystem, I look forward to keeping you updated on our progress throughout the year."

Q4 Financial highlights

Group highlights

Group net sales were €20.1 billion, up 0.1% at constant exchange rates, and increased 2.8% at actual exchange rates. Excluding last year's 53rd week, Q4 Group net sales grew by 6.7% at constant exchange rates. Group net sales were driven by positive contributions from comparable sales growth excluding gasoline of 3.2%, acquisitions, and foreign currency translation benefits, which were partially offset by a 53rd week in 2020. Q4 Group comparable sales had a net negative impact of approximately 0.1 percentage points, from unfavorable weather impacts, which were partially offset by favorable calendar shifts.

On a two-year comparable sales stack basis, growth for the Group of 14.2% in Q4 2021 compares to the 12.2% growth posted in Q3.

In Q4, Group net consumer online sales grew 13.2% at constant exchange rates versus a 14-week quarter in 2020, due to continued growth at bol.com and the overall online grocery business. Q4 Group net consumer online sales also benefited from the FreshDirect acquisition. On a 13-week comparable basis, Q4 Group net consumer online sales grew 21.5% at constant exchange rates, which builds on top of 71.7% growth in Q4 2020.

In Q4, Group underlying operating margin was 4.2%, flat compared to the prior year at constant exchange rates, as sales leverage and strong cost-saving initiatives offset higher supply chain costs and inflationary cost pressures. In Q4, Group IFRS-reported operating income was €895 million, representing an IFRS-reported operating margin of 4.4%.

Underlying income from continuing operations was €598 million, up 6.7% in the quarter at actual rates. Ahold Delhaize's IFRS-reported net income in the quarter was €634 million. Diluted EPS was €0.62 and diluted underlying EPS was €0.59, up 10.2% at actual currency rates compared to last year's results. In the quarter, 9.9 million own shares were purchased for €299 million, bringing the total amount for the full year to €1 billion.

2021 diluted underlying EPS of €2.19 increased 28.8% over the 2019 base, and significantly exceeded the Company's original guidance of mid- to high-single-digit growth versus 2019. This upside compared with the original guidance came from strong food-at-home demand and better than expected Group underlying operating margins of 4.4%, compared to original guidance of "at least 4%." This drove strong cash generation, with the Company's €1.6 billion reported free cash flow including payments of $190 million (~€170 million) for U.S. pensions following 2020 U.S. MEP withdrawals and approximately €380 million related to a disputed Belgian tax claim. Excluding these two items, 2021 free cash flow would have amounted to €2.2 billion.

U.S. highlights

U.S. net sales increased by 1.5% at constant exchange rates (5.9% at actual exchange rates). Excluding last year's 53rd week, Q4 U.S. net sales grew by 9.2% at constant exchange rates. U.S. comparable sales excluding gasoline increased 4.8%. Unfavorable weather negatively impacted Q4 U.S. comparable sales by approximately 0.2 percentage points. On a two-year comparable sales stack basis, growth was 16.0%, accelerating from the 15.3% growth in Q3. Brand performance continued to be led by Food Lion, which has now delivered 37 consecutive quarters of positive sales growth.

In Q4, online sales in the segment were up 30.5% in constant currency, driven by the continued expansion of click-and-collect facilities and the FreshDirect acquisition. Excluding the FreshDirect acquisition, U.S. online sales grew 7.5% in constant currency, building on top of the significant 128.5% growth in the same quarter last year.

Underlying operating margin in the U.S. was 4.4%, up 0.5 percentage points at constant exchange rates from the prior year period, driven by reduced COVID-19-related costs and strong cost-savings initiatives. While the absence of one-time costs in the prior year quarter were offset by lapping last year's extra week, Q4 U.S. underlying operating margins benefited by 0.3 percentage points from a favorable reserve release. In Q4, U.S. IFRS-reported operating margin was 5.5%.

Europe highlights

European net sales declined by 1.9% at constant exchange rates and 1.5% at actual exchange rates, driven by a 53rd week in 2020. Excluding last year's 53rd week, Q4 net sales in Europe grew by 3.0% at constant exchange rates. Europe's comparable sales excluding gasoline grew 1.0%. Despite lapping strong comparable sales growth excluding gasoline in Q4 2020 of 10.6%, comparable sales were able to grow year-over-year on the back of continued market share gains. Albert Heijn was a particular standout in the quarter, with positive market share results driven by strong execution, successful marketing campaigns, sales uplifts provided by the brand’s store remodeling activities and the acquired DEEN stores.

A calendar shift positively impacted Q4 comparable sales in Europe by approximately 0.1 percentage points. On a two-year comparable sales stack basis for Q4 2021, growth was 11.6%, an acceleration compared to growth of 7.3% in Q3 2021.

In Q4, net consumer online sales in the segment were up 7.4%, following 73.4% growth in the same period last year. At bol.com, our online retail platform in the Benelux, net consumer sales grew by 7.8% in Q4 (15.3% on a comparable 13-week basis), which comes on top of nearly 70% growth in the same quarter last year. Bol.com's sales from third-party sellers grew 9.1% in the quarter (17.2% on a comparable 13-week basis) representing 56% of net consumer sales, with nearly 49,000 merchant partners on the platform.

Underlying operating margin in Europe was 4.1%. This compares to an underlying operating margin of 5.1% in the prior year quarter when margins sustained unusual benefits from lockdown conditions in Europe. In Q4, Europe's IFRS-reported operating margin was 3.1%.

Outlook

Management remains confident in the Company's ability to grow sales in 2022, as originally indicated during the November Investor Day. Strong sales are expected to result from current trends in consumer behavior favoring more food-at-home consumption and online food purchases, which fit well with Ahold Delhaize's omnichannel business model and growth investments.

While supply chain disruptions, inflation and rising costs as well as the expected easing of government subsidies to consumers pose challenges for the industry in 2022, Ahold Delhaize's Group underlying operating margin is expected to be at least 4.0%, in line with the Company's historical profile. Management believes that the Company's brands continue to offer consumers a strong shopping proposition and are well positioned to maintain profitability in the current inflationary environment. Margins are expected to be supported by a strong Save for Our Customers target of above €850 million. This should help offset cost pressures related to inflation and supply chain issues, along with the negative impact to margins from increased online sales penetration. The 2022 target builds on €967 million of savings from 2021, which significantly exceeded original guidance forecasting savings of over €750 million.

Underlying EPS is expected to decline by low- to mid-single-digits versus 2021, driven primarily by a return to historical margin levels in 2022 compared with elevated 2021 levels.

Free cash flow is expected to be approximately €1.7 billion. Net capital expenditures are expected to total around €2.5 billion, reflecting a step up in the Company's investments in its digital and omnichannel offering to support accelerated sales growth. In addition, Ahold Delhaize remains committed to its dividend policy and share buyback program in 2022, as previously stated. We expect to grow the full-year dividend in 2022 to €0.95 per share, and have previously announced a €1 billion share repurchase program for 2022.

- Excludes M&A.

- Calculated as a percentage of underlying income from continuing operations.

- Management remains committed to the share buyback and dividend program, but, given the uncertainty caused by COVID-19, will continue to monitor macroeconomic developments. The program is also subject to changes in corporate activities, such as material M&A activity.

Cautionary notice

This communication contains information that qualifies as inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation.

This communication includes forward-looking statements. All statements other than statements of historical facts may be forward-looking statements. Words and expressions such as 2022, outlook, forecast(s)/(ing), continue(d)/(ing)/(s), commit(ted)/(ment), propose, strong start, next phase, strategy, maintain(ing), remain(s), expect/(s)/(ed)/(ation), scheduled, will, priority, beyond, begin, 2025, ensure/(ing), projected, coming years, progress, intent(ed)/(ion), reach, no later than, 2040, future, throughout, confident, well positioned, should, guidance, expect(ed), target, ambition, mitigate, focus or other similar words or expressions are typically used to identify forward-looking statements.

Forward-looking statements are subject to risks, uncertainties and other factors that are difficult to predict and that may cause the actual results of Koninklijke Ahold Delhaize N.V. (the “Company”) to differ materially from future results expressed or implied by such forward-looking statements. Such factors include, but are not limited to, risks relating to the Company’s inability to successfully implement its strategy, manage the growth of its business or realize the anticipated benefits of acquisitions; risks relating to competition and pressure on profit margins in the food retail industry; the impact of economic conditions on consumer spending; turbulence in the global capital markets; political developments, natural disasters and pandemics; climate change; raw material scarcity and human rights developments in the supply chain; disruption of operations and other factors negatively affecting the Company’s suppliers; the unsuccessful operation of the Company’s franchised and affiliated stores; changes in supplier terms and the inability to pass on cost increases to prices; risks related to environmental, social and governance matters (including performance) and sustainable retailing; food safety issues resulting in product liability claims and adverse publicity; environmental liabilities associated with the properties that the Company owns or leases; competitive labor markets, changes in labor conditions and labor disruptions; increases in costs associated with the Company’s defined benefit pension plans; the failure or breach of security of IT systems; the Company’s inability to successfully complete divestitures and the effect of contingent liabilities arising from completed divestitures; antitrust and similar legislation; unexpected outcomes in the Company’s legal proceedings; additional expenses or capital expenditures associated with compliance with federal, regional, state and local laws and regulations; unexpected outcomes with respect to tax audits; the impact of the Company’s outstanding financial debt; the Company’s ability to generate positive cash flows; fluctuation in interest rates; the change in reference interest rate; the impact of downgrades of the Company’s credit ratings and the associated increase in the Company’s cost of borrowing; exchange rate fluctuations; inherent limitations in the Company’s control systems; changes in accounting standards; adverse results arising from the Company’s claims against its self-insurance program; the Company’s inability to locate appropriate real estate or enter into real estate leases on commercially acceptable terms; and other factors discussed in the Company’s public filings and other disclosures.

Forward-looking statements reflect the current views of the Company’s management and assumptions based on information currently available to the Company’s management. Forward-looking statements speak only as of the date they are made, and the Company does not assume any obligation to update such statements, except as required by law.