We will publish our Q4 2024 results on February 12, 2025

Find all info here

Investor Relations

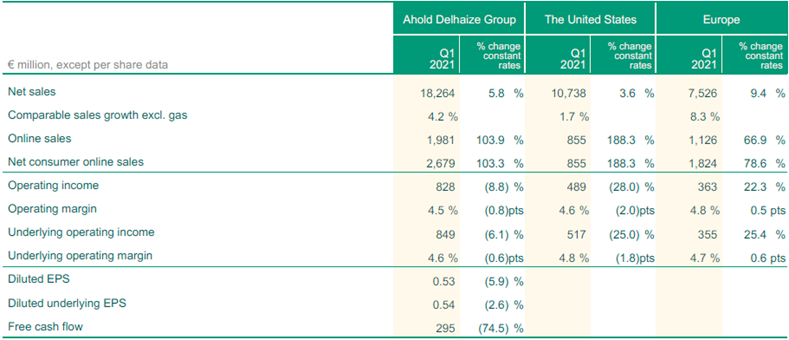

Our Q1 2021 numbers in a nutshell

Press release

Ahold Delhaize reports solid Q1 results with an accelerated two-year comparable sales growth rate**; raises full-year earnings guidance

- In Q1, the COVID-19 pandemic continued to impact the local communities and brands of Ahold Delhaize, resulting in approximately €150 million spent to support customers, associates and communities with COVID-19 relief care.

- On a two-year comparable sales growth basis**, comparable sales excluding gas in the U.S. increased 15.5% and in Europe were up 18.1% in Q1 2021, a sequential acceleration versus growth in Q4 2020 of 13.5% and 13.9%, respectively.

- Net sales were €18.3 billion, up 5.8% in Q1 at constant exchange rates.

- In the U.S. and Europe, comparable sales excluding gas grew 1.7% and 8.3% in Q1, respectively.

- Net consumer online sales sequentially accelerated to 103.3% in Q1 at constant exchange rates, including U.S. growth of 188.3% and 78.6% growth in Europe.

- Underlying operating margin was 4.6%; diluted underlying EPS was €0.54.

- IFRS-reported operating income was €828 million in Q1; IFRS-reported diluted EPS was €0.53.

- Raising 2021 underlying EPS and Group net consumer online sales outlook; expect underlying EPS to grow in the low- to mid-teen range versus 2019 and Group net consumer online sales to grow over 40% versus the prior year.

**Two-year comparable sales growth is a stack of the comparable sales growth excluding gasoline in the current year period added to the comparable sales growth excluding gasoline in the prior year period. This measure may be helpful to improve the understanding of trends in periods that are affected by variations in prior year growth rates.

Zaandam, the Netherlands, May 12, 2021 – Ahold Delhaize, one of the world’s largest food retail groups and a leader in both supermarkets and e-commerce, reports first quarter results today.

Summary of key financial data

Comments from Frans Muller, President and CEO of Ahold Delhaize

"As we pass the one-year mark of the COVID-19 pandemic, its effects continue to have an impact across our geographies. In Q1, our brands, together with our suppliers, remained focused on fulfilling their vital role in society by maintaining food and product supplies to local communities. In addition, our U.S. brands have supported vaccination efforts. I remain thankful for the efforts of associates across all our stores, distribution centers and support offices during these challenging times. Our consistent focus on safety, while at the same time providing great customer service and community support, have helped drive a strong quarter relative to our expectations. Although COVID-19 continues to impact our results, we have now entered a period where our year-over-year growth rates are affected by the lapping of difficult prior year comparisons.

"That said, we begin 2021 in a strategically stronger position than before the COVID-19 pandemic began. We remain focused on making additional investments to meet associate, customer and community needs – including approximately €20 million pledged evenly between the U.S. and Europe for charitable donations this year, as well as continued support of health and safety measures, which remains a top priority to enable us to further strengthen our brands' positions as leading local omnichannel retailers. These investments in COVID-19-related care total approximately €150 million, more than double the €70 million incurred in the same quarter last year.

"We are pleased with the underlying Q1 performance in both the U.S. and Europe. The two-year comparable sales stack sequentially accelerated in Q1 2021 versus Q4 2020 in both the U.S. and Europe, as we've been able to retain a strong level of underlying consumer demand by continuing to adapt to the enduring consumer behavior changes, including increased working from home, preference for healthy and fresh products, and higher online demand. Our brands were well positioned to satisfy the changing needs and preferences of their customers, many of which were trends already developing prior to COVID-19. As these trends accelerated during COVID-19, our brands have evolved more quickly to adapt. Growth in our leading local omnichannel platform also sequentially accelerated, with nearly 190% net consumer online sales growth in the U.S. and nearly 80% growth in Europe in the quarter, at constant exchange rates. Underlying operating margins were strong in the context of historical levels prior to COVID-19. While COVID-19 continues to create significant uncertainty in 2021, the outstanding Q1 results provide us with the confidence to raise our underlying EPS and Group net consumer online sales growth outlook for the year.

"Investing in our business in order to solidify our position as an industry-leading local omnichannel retailer in 2021 and beyond remains a key priority. We continued to build upon several important initiatives to increase our share of the consumer wallet and improve online capabilities, including increasing our online capacity, driven in part by our recently opened U.S. click-and-collect locations; moving forward with the launch of Ship2Me in the U.S., an “endless aisle” offering of over 100,000 general merchandise and food items, in the second half of the year; and rolling out the no-fee home delivery service AH Compact to additional markets in the Netherlands. With increased capacity and strong momentum, we now expect Group net consumer online sales to grow by over 40% in 2021 versus 30% previously. This includes the raised expectations for over 70% growth in U.S. online sales, versus over 60% growth previously, and at least €5.5 billion in net consumer online sales at bol.com, versus at least €5 billion previously.

"We also continue to make progress in elevating our Health and Sustainability strategy, and recently announced a new goal for all of our brands to achieve net-zero carbon emissions by 2050. In March, Albert Heijn was voted by consumers as the Netherlands' most sustainable supermarket chain in the Sustainable Brand Index 2021 ranking for the fifth consecutive year. The GIANT Company in the U.S. announced a new partnership with the Rodale Institute in February to develop solutions for the regenerative organic agriculture movement. We also successfully priced our inaugural sustainability-linked bond in March, amounting to €600 million with a term of nine years, linked to achieving targets in reducing food waste and scope 1 and 2 carbon emissions by 2025."

Q1 Financial highlights

Group highlights

Group net sales were €18.3 billion, up 0.3% at actual exchange rates and up 5.8% at constant exchange rates, driven largely by 4.2% comparable sales growth excluding gasoline. Group comparable sales were positively impacted in part by demand related to COVID-19, particularly within Europe. To a lesser extent, comparable sales benefited by approximately 1.3 percentage points from favorable calendar shifts and a weather impact in 2021. On a two-year comparable sales stack basis, growth for the group sequentially accelerated to 16.4% in Q1 2021 versus 13.7% in Q4 2020. Group net consumer online sales grew 103.3% in Q1 at constant exchange rates, aided by the FreshDirect acquisition, which closed on January 5.

Group underlying operating margin in Q1 was 4.6%, down 0.6 percentage points from the prior year at constant exchange rates, as margins lapped unusually high levels in the prior year due to COVID-19. Margins in 2020 benefited largely from the timing of unexpectedly higher sales that preceded the timing of significant costs related to COVID-19 in the U.S., an effect which did not recur this year. The group underlying operating margin in Q1 was therefore negatively impacted by COVID-19-related costs of approximately €150 million. Group IFRS-reported operating margin was 4.5% in Q1.

Underlying income from continuing operations was €566 million, down 11.9% in the quarter. Ahold Delhaize's IFRS-reported net income in the quarter was €550 million. Diluted EPS was €0.53 and diluted underlying EPS was €0.54, down (8.4)% compared to last year's record Q1 results. Management believes that framing 2021 diluted underlying EPS growth relative to 2019 (prior to COVID-19) provides a helpful context for investors. Therefore, compared to Q1 2019, diluted underlying EPS in the quarter was up approximately 38%. In the quarter, 13.6 million own shares were purchased for €312 million.

U.S. highlights

U.S. comparable sales excluding gasoline grew 1.7%, positively impacted by demand related to COVID-19, particularly in January and February. To a lesser extent, comparable sales were also favorably impacted by approximately 1.7 percentage points from calendar shifts and a weather impact. This was offset, in part, by a decline in March's comparable sales, which were unfavorably impacted by the lapping of significant consumer stock-up activity related to COVID-19 in 2020, when comparable sales excluding gasoline grew 33.8%. On a two-year comparable sales stack basis for Q1 2021, growth was 15.5%, a sequential acceleration versus the 13.5% growth in Q4 2020. Brand performance was led by Food Lion.

Online sales in the segment were up 188.3% in constant currency, driven in part by the aforementioned FreshDirect acquisition. Excluding the FreshDirect acquisition, the U.S. online sales growth rate in Q1 2021 sequentially accelerated to 135.2% growth versus the 128.5% growth Q4 2020.

Underlying operating margin in the U.S. was 4.8%, down 1.8 percentage points from the prior year at constant exchange rates, as margins lapped unusually high levels in the prior year due to COVID-19. Margins in 2020 benefited largely from the timing of unexpectedly higher sales that preceded the timing of significant costs related to COVID-19, an effect which did not recur in Q1 2021.

Europe highlights

Europe's comparable sales excluding gasoline grew 8.3%, positively impacted by demand related to COVID-19, particularly in January and February. To a lesser extent, Q1 comparable sales were favorably impacted by approximately 0.5 percentage points from calendar shifts in 2021. Comparable sales remained positive in March despite the lapping of significant consumer stock-up activity related to COVID-19 in 2020, when comparable sales excluding gasoline grew 15.9%. On a two-year comparable sales stack basis for Q1 2021, growth was 18.1%, a sequential acceleration versus the 13.9% growth in Q4 2020. The strong growth was led by the brands in the Benelux and Czech Republic.

Net consumer online sales in the segment were up 78.6% in Q1 2021, a sequential acceleration versus the 73.4% growth in Q4 2020. At bol.com, the online retail platform in the Benelux included within the Europe segment's results, net consumer sales grew by 76.6%, a sequential acceleration versus the 69.6% growth in Q4 2020. Bol.com's sales from third-party sellers grew 101% in the quarter, with nearly 45,000 merchant partners on the platform.

Underlying operating margin in Europe was 4.7%, up 0.6 percentage points from the prior year at constant exchange rates. Margin expansion was driven by operating leverage from strong sales growth as a result of COVID-19.

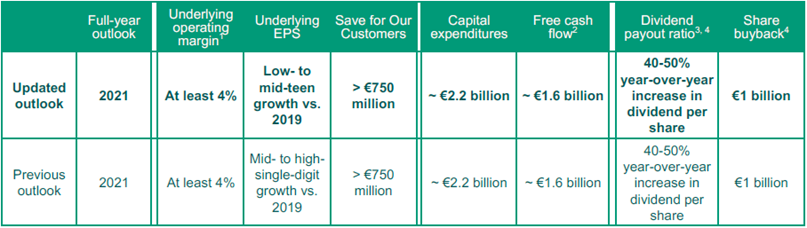

Outlook

While COVID-19 continues to create significant uncertainty for the remainder of 2021, the strong Q1 results provide management the confidence to raise the underlying EPS growth outlook for the year.

As a reminder, COVID-19, and to a lesser extent, a 53-week calendar, significantly distorted Ahold Delhaize's 2020 financial results. Lapping these effects will impact results in 2021, which returns to a 52-week calendar.

In 2021, the underlying operating margin outlook of at least 4% is unchanged. This outlook reflects a balanced approach, with cost savings of over €750 million largely offsetting cost pressures related to COVID-19, that are expected to continue (albeit at a lower level than 2020), and the impact from increased online sales penetration.

The underlying EPS guidance was raised and now expected to grow in the low- to mid-teen range relative to 2019 versus mid- to high-single-digit growth previously. Management believes that framing 2021 underlying EPS guidance relative to 2019, which was prior to COVID-19 and also on a 52-week calendar, provides a helpful context for investors.

The free cash flow outlook is unchanged at approximately €1.6 billion. This puts the Company on track to reach €5.6 billion in cumulative free cash flow from 2019-2021 (averaging nearly €1.9 billion annually), which exceeds the Capital Markets Day 2018 target of €5.4 billion (averaging €1.8 billion annually). Capital expenditure is expected to be around €2.2 billion, and reflects the Company's higher investments in digital and omnichannel capabilities and for improvements related to recent M&A. In addition, Ahold Delhaize remains committed to its dividend policy and share buyback program in 2021, as previously stated.

- No significant impact to underlying operating margin from returning to a 52-week calendar versus a 53-week calendar in 2020, though the return to a 52-week calendar will negatively impact net sales for the full year by 1.5-2.0%. Comparable sales growth will be presented on a comparable 52-week basis.

- Excludes M&A.

- Calculated as a percentage of underlying income from continuing operations.

- Management remains committed to the share buyback and dividend program, but given the uncertainty caused by COVID-19, they will continue to monitor macroeconomic developments. The program is also subject to changes in corporate activities, such as material M&A activity.

Webcast

Cautionary notice

This communication contains information that qualifies as inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation.

This communication includes forward-looking statements. All statements other than statements of historical facts may be forward-looking statements. Words and expressions such as full-year, guidance, outlook, remain(s), continue(s)/(d), consistent, focus, impact, expect(ed), this year, further, strengthen, leading, enduring, constant, growth, improve, momentum, now, will, 2021, expectations, progress, 2050, by, 2025, remainder of 2021, confidence, believes, to be, subject to or other similar words or expressions are typically used to identify forward-looking statements.

Forward-looking statements are subject to risks, uncertainties and other factors that are difficult to predict and that may cause the actual results of Koninklijke Ahold Delhaize N.V. (the “Company”) to differ materially from future results expressed or implied by such forward-looking statements. Such factors include, but are not limited to, risks relating to the Company’s inability to successfully implement its strategy, manage the growth of its business or realize the anticipated benefits of acquisitions; risks relating to competition and pressure on profit margins in the food retail industry; the impact of economic conditions on consumer spending; turbulence in the global capital markets; political developments, natural disasters and pandemics; climate change; raw material scarcity and human rights developments in the supply chain; disruption of operations and other factors negatively affecting the Company’s suppliers; the unsuccessful operation of the Company’s franchised and affiliated stores; changes in supplier terms and the inability to pass on cost increases to prices; risks related to corporate responsibility and sustainable retailing; food safety issues resulting in product liability claims and adverse publicity; environmental liabilities associated with the properties that the Company owns or leases; competitive labor markets, changes in labor conditions and labor disruptions; increases in costs associated with the Company’s defined benefit pension plans; the failure or breach of security of IT systems; the Company’s inability to successfully complete divestitures and the effect of contingent liabilities arising from completed divestitures; antitrust and similar legislation; unexpected outcomes in the Company’s legal proceedings; additional expenses or capital expenditures associated with compliance with federal, regional, state and local laws and regulations; unexpected outcomes with respect to tax audits; the impact of the Company’s outstanding financial debt; the Company’s ability to generate positive cash flows; fluctuation in interest rates; the change in reference interest rate; the impact of downgrades of the Company’s credit ratings and the associated increase in the Company’s cost of borrowing; exchange rate fluctuations; inherent limitations in the Company’s control systems; changes in accounting standards; adverse results arising from the Company’s claims against its self-insurance program; the Company’s inability to locate appropriate real estate or enter into real estate leases on commercially acceptable terms; and other factors discussed in the Company’s public filings and other disclosures.

Forward-looking statements reflect the current views of the Company’s management and assumptions based on information currently available to the Company’s management. Forward-looking statements speak only as of the date they are made, and the Company does not assume any obligation to update such statements, except as required by law.