We published our Annual Report 2024 on February 26, 2025

Find all info here

Investor Relations

Our Q4 & FY numbers in a nutshell

with CEO Frans Muller and CFO Jolanda Poots-Bijl

PRESS RELEASE

Ahold Delhaize reports Q4 2023 financial results, introduces outlook for 2024

- Throughout 2023, we have been steadfast in creating value for customers. Our brands expanded their high-quality own brand assortments, optimized loyalty programs and provided a seamless shopping experience both in-store and online. In addition, our teams pulled together to deliver a record of more than €1.25 billion in cost savings to invest back into our customer value proposition.

- Q4 Group net sales were €23.0 billion, up 1.9% at constant exchange rates and down 1.4% at actual exchange rates. Q4 comparable sales excluding gas increased by 1.8% for the Group, with a decline of 1.0% in the U.S. and an increase of 6.5% in Europe.

- Net consumer online sales increased by 2.6% in Q4 at constant exchange rates. Double-digit growth at Food Lion and Hannaford and accelerating growth at Albert Heijn was partially offset by FreshDirect.

- Q4 underlying operating margin was 4.3%, a decrease of 0.1 percentage points. One-off adjustments in the U.S. partially offset declines in European margin and in insurance benefits at the Global Support Office.

- Q4 IFRS operating income was €675 million and IFRS diluted EPS was €0.47. IFRS results were mainly impacted by a €250 million loss on the divestment of FreshDirect.

- Q4 diluted underlying EPS was €0.73, an increase of 2.5% compared to the prior year at actual rates.

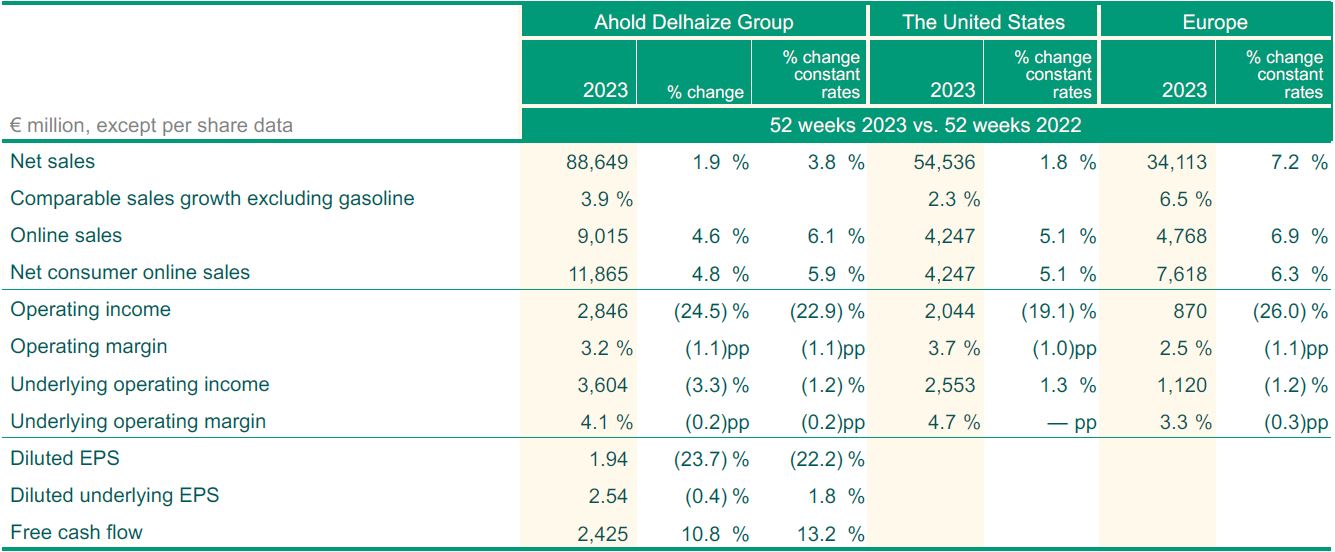

- 2023 full year Group net sales were €88.6 billion; underlying operating margin was 4.1% and diluted underlying EPS was €2.54, in line with initial expectations for the year.

- 2023 full year IFRS operating income was €2,846 million and IFRS diluted EPS was €1.94. IFRS results were mainly impacted by the costs associated with Accelerate initiatives.

- 2023 free cash flow was €2.4 billion, which is at the higher end of our most recent guidance range of €2.2-€2.4 billion.

- Management proposes a cash dividend of €1.10 for fiscal year 2023, which is a 4.8% increase compared to 2022, and in line with our dividend payout policy.

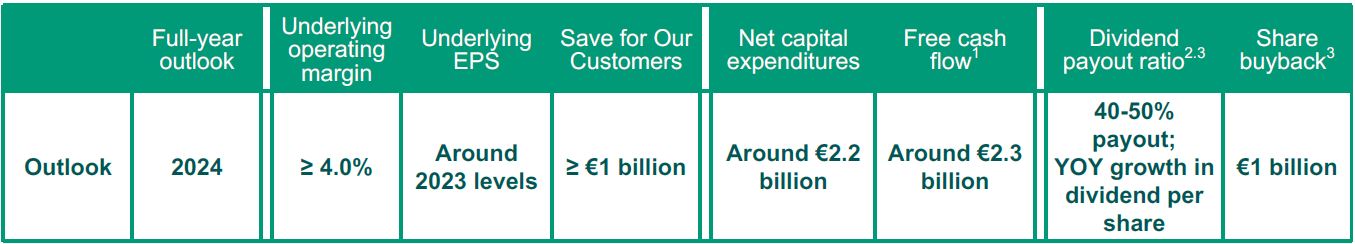

- 2024 outlook: underlying operating margin of ≥4.0%; underlying EPS at around 2023 levels; free cash flow of around €2.3 billion; and net capital expenditures of around €2.2 billion.

Zaandam, the Netherlands, February 14, 2024 – Ahold Delhaize, one of the world’s largest food retail groups and a leader in both supermarkets and e-commerce, reports fourth quarter results today.

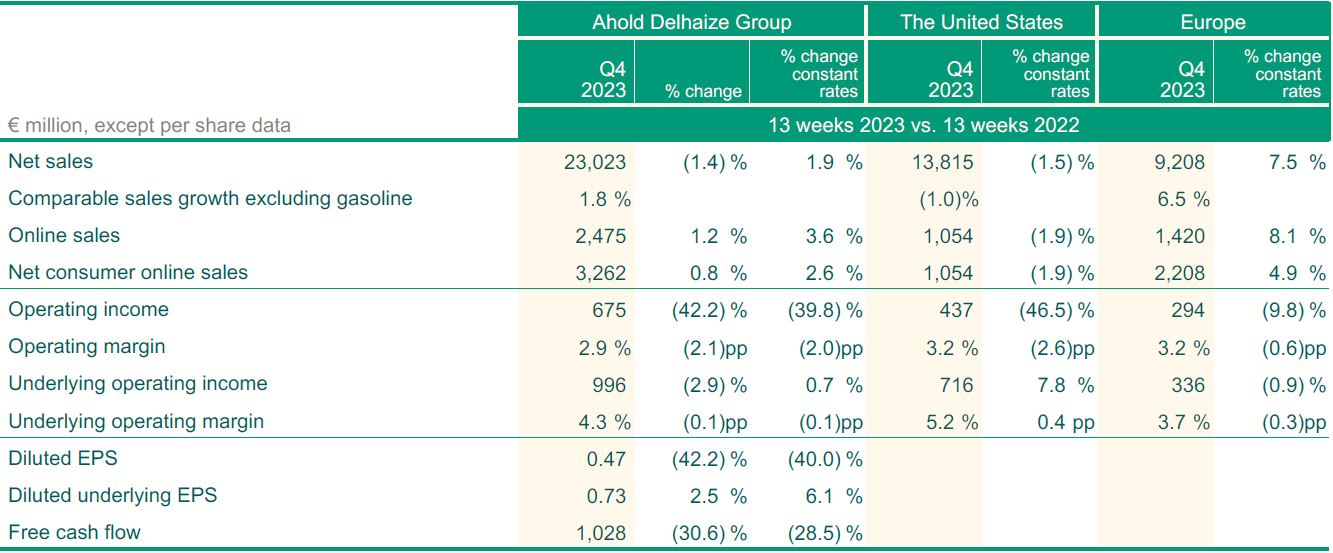

Summary of key financial data

Comments from Frans Muller, President and CEO of Ahold Delhaize

“I am pleased to report a solid end to the year for Ahold Delhaize. The local brands in our strong international portfolio have been steadfast in creating value for customers by enhancing their highly personalized loyalty programs, increasing access to omnichannel offerings, and expanding their innovative own-brand assortments. In an increasingly complex world, our brands are able to deliver consistency to customers, associates and suppliers, quarter after quarter.

"Disciplined cost management is more important than ever to mitigate cost increases for customers, especially as global conflicts create potential volatility in supply chains. In 2023, we left no stone unturned and significantly exceeded our original Save for Our Customers goals, generating over €1.25 billion in cost savings, which is 29% more than we generated in the prior year.

"Our role as a company goes beyond just the price on the shelf. We believe it is also our responsibility to serve communities, help with broader societal challenges and foster a nurturing environment for associates to thrive. To this end, our brands contributed more than €240 million in charitable cash, product and food donations to local and regional food banks and non-profit organizations throughout the year.

"In Q4, Group net sales increased by 1.9% at constant rates, while comparable sales increased by 1.8%. We delivered an underlying operating margin of 4.3% and diluted underlying EPS growth of 2.5%. One-off adjustments in the U.S. partially offset declines in European margin and in insurance benefits at the Global Support Office. On an IFRS basis, we delivered operating income of €675 million and diluted EPS of €0.47. IFRS results were negatively impacted by the loss on the divestment of FreshDirect.

"In the U.S., net sales decreased by 1.5% at constant rates and comparable sales declined by 1.0%, in line with our expectations, as inflation moderated further and Supplemental Nutrition Assistance Program (SNAP) headwinds remained. With the backdrop of a declining U.S. grocery market, Food Lion achieved a remarkable milestone with 45 consecutive quarters of positive comparable sales growth. Excluding one- offs, the U.S. underlying operating margin was consistent with the prior year, highlighting our strong focus on managing costs to match top-line deflation trends. In addition, the divestment of FreshDirect was finalized in the quarter, which contributed a modest uplift to margin. For the coming quarters, this margin upside will help fund investments into our U.S. brands' store portfolio and customer value propositions.

"In Europe, net sales were up 7.5% at constant rates and comparable store sales were up 6.5% in Q4. This is a strong result, and comes along with the first positive volume trends in over two years. Key to this milestone has been our brands' relentless focus on rolling out local everyday low-price programs. Our brands have expanded their offering in the region to 7,000 own-brand products, meeting customers’ needs for high-quality, affordable items. Online grocery sales were up 9.3% with accelerating growth at Albert Heijn. Underlying operating margin was 3.7%, a sequential quarter-over-quarter improvement since we announced Delhaize Belgium's Future Plan and strong cost-control measures to compensate for high inflation in the cost base, particularly impacting labor. At Delhaize, 107 stores have now signed agreements with independent buyers. And we are starting to see encouraging results, with accelerating comparable store sales and stabilizing market share at converted stores.

"Our 2023 diluted underlying EPS of €2.54 decreased by 0.4% at actual rates compared to 2022, in line with the Company's original guidance of around prior year levels. Free cash flow in 2023 was €2.4 billion, reflecting ongoing solid and consistent operating cash flows, inflows related to the collection of a tax receivable in Belgium and outflows related to the delivery of various projects identified as part of the Accelerate operational efficiency initiative.

"Elevating health and sustainability remains a key strategic focus. In 2023, we reduced greenhouse gas (GHG) emissions in our own operations by 35% compared to our 2018 baseline. Our total tons of food waste per food sales was 37% lower than our 2016 baseline, and we are reporting a 10% reduction in virgin own-brand plastic packaging compared to 2021. Our brands continued to increase the percentage of own- brand healthy food sales, reaching 54.8% in 2023, up 0.4 percentage points compared to 2022.

"In December 2023, we published our updated Climate Plan. It provided updates in three key areas, describing how we quantified potential GHG-emissions reduction per decarbonization lever, sharpened the categories for our value chain emissions-reduction target, and addressed challenges in meeting our overall reduction targets. Reducing overall emissions requires effort-based collaboration with our stakeholders across the entire value chain, which is why our brands in Europe have launched climate hubs to help educate their suppliers and support them in taking the first steps towards building their own GHG-emissions reduction plans.

"For 2024, we expect a predominantly consistent performance year-over-year, albeit with some different phasing across the quarters – as, for example, we lap the impacts of inflation rates, SNAP and the various positive and negative impacts of the prior year's transformational initiatives in Europe and the U.S. Our Group underlying margin is expected to be at least 4%. Earnings per share are expected to be around 2023 levels and free cash flow at around €2.3 billion. And, as always, you can expect us to be laser focused on cost control and cash flow delivery.

"We are also looking forward to hosting our Strategy Day in the Netherlands in May, at which we will talk about the many opportunities we see in front of us to kick off a new phase of momentum. Some of the themes we will outline include: maintaining a relentless focus on the customer; leveraging the strength of our great local brands, including a more deliberate and holistic reset of Stop & Shop; simplifying our organization to sustain growth investments; and deploying capital in a more surgical way to support our biggest opportunities."

Q4 Financial highlights

Group highlights

Group net sales were €23.0 billion, an increase of 1.9% at constant exchange rates, and down 1.4% at actual exchange rates. Group net sales were driven by comparable sales growth excluding gasoline of 1.8%, partially offset by lower gasoline sales. Q4 Group comparable sales had a net negative impact of approximately 0.3 percentage points from weather and calendar shifts, primarily related to the timing of New Year's Eve.

In Q4, Group net consumer online sales increased by 2.6% at constant exchange rates. Double-digit growth at Food Lion and Hannaford and accelerating growth at Albert Heijn was partially offset by FreshDirect.

Group underlying operating margin was 4.3%, a decrease of 0.1 percentage points at constant exchange rates. One-off adjustments in the U.S. partially offset declines in European margin and in insurance benefits at the Global Support Office. In Q4, Group IFRS operating income was €675 million, representing an IFRS operating margin of 2.9%, mainly impacted by a €250 million loss on the divestment of FreshDirect and €60 million for restructuring-related costs pertaining to Accelerate initiatives.

Underlying income from continuing operations was €700 million, a decrease of 1.1% in the quarter at actual rates. Ahold Delhaize's IFRS net income in the quarter was €451 million. Diluted EPS was €0.47 and diluted underlying EPS was €0.73, up 2.5% at actual currency rates compared to last year's results. In the quarter, Ahold Delhaize purchased 8.2 million own shares for €225 million, bringing the total year-to-date amount to €1 billion.

U.S. highlights

U.S. net sales were €13.8 billion, a decrease of 1.5% at constant exchange rates and down 6.5% at actual exchange rates. U.S. comparable sales excluding gasoline decreased by 1.0%, and had a net negative impact of approximately 0.5 percentage points from weather and calendar shifts, primarily related to the timing of New Year's Eve. Strong growth in pharmacy was offset by the non-recurrence of emergency SNAP benefits, the moderation of inflation rates and lower gasoline sales. Food Lion and Hannaford continue to lead the U.S. brands' performance with 45 and 10 consecutive quarters of positive sales growth, respectively.

In Q4, online sales in the segment declined 1.9% in constant currency, driven by declining performance of FreshDirect in Q4 and its divestment, as of December 6.

Underlying operating margin in the U.S. was 5.2%, up 0.4 percentage points, primarily due to favorable reserve release and one-off settlements and a modest margin mix benefit from the divestment of FreshDirect. This was partially offset by an increase in shrink. In Q4, U.S. IFRS operating margin was 3.2%, mainly impacted by a €250 million loss on the divestment of FreshDirect.

Europe highlights

European net sales were €9.2 billion, an increase of 7.5% at constant exchange rates and 7.4% at actual exchange rates. The higher net sales were due to an increase in comparable sales of 6.5% and the net opening of new stores, including the conversion of Jan Linders stores.

In Q4, net consumer online sales increased by 4.9%. Online sales in grocery increased by 9.3%.

Underlying operating margin in Europe was 3.7%, down 0.3 percentage points. Higher wages and investments in our customer value proposition were partially offset by a decrease in the non-cash service charge for the Netherlands' employee pension plan. Europe's Q4 IFRS operating margin was 3.2%, mainly impacted by €32 million for restructuring-related costs pertaining to Belgium initiatives.

Outlook

The following are changes in the business that will impact comparable performance for 2024 and have been incorporated into our Outlook:

-

The divestment of FreshDirect will reduce the amount of 2024 reported net sales and online sales for the U.S. segment by $600 million.

- Albert Heijn net sales will be impacted by the cessation of tobacco sales in 2024. Albert Heijn stopped selling tobacco in its own operated supermarkets on January 1, 2024. This will have around a two to three percentage-point impact on reported and comparable store sales in Europe in 2024.

The acquisition of Profi is expected to close in the second half of 2024, and will double the size of operations in Romania. As the timing of the closing is uncertain, our 2024 Outlook excludes any impact from this transaction.

Ahold Delhaize's Group underlying operating margin is expected to be ≥4.0%, in line with the Company's historical profile. Margins will be supported by Save for Our Customers programs of ≥€1 billion in savings in 2024. This should help to offset pressures related to cost and wage inflation, along with the negative impact on margins from increased online sales penetration.

Underlying EPS is expected to be around 2023 levels at current exchange rates. Our earnings guidance implies further growth and a strong underlying operating performance, which will offset the impact of anticipated moderate declines in interest rates.

Free cash flow is expected to be around €2.3 billion. Net capital expenditures are expected to total around €2.2 billion, lower than the prior year, mainly due to divestments of facilities in the U.S. Overall, we continue to maintain strong levels of investments into our brands' store networks and further rollout of omnichannel capabilities, as well as in advancing our healthy and sustainable initiatives.

In addition, Ahold Delhaize remains committed to its dividend policy and share buyback program in 2024, as previously stated. We are proposing a full-year dividend for 2023 of €1.10 per share and have previously announced a €1 billion share purchase program for 2024.

A detailed Outlook will be provided in the Annual Report 2023, which will be published on February 28, 2024.

- Excludes M&A.

- Calculated as a percentage of underlying income from continuing operations.

- Management remains committed to our share buyback and dividend programs, but, given the uncertainty caused by the wider macro-economic consequences due to increased geopolitical unrest, will continue to monitor macro-economic developments. The program is also subject to changes resulting from corporate activities, such as material M&A activity.

Cautionary notice

This communication contains information that qualifies as inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation. This communication includes forward-looking statements. All statements other than statements of historical facts may be forward-looking statements. Words and expressions such as outlook, through(out), expand(ed)/(ing), accelerating, mainly, impact(s)/(ed)/(ing), by, (full) year, expect(ations)/(ed), higher end, guidance, propos(e)/(es)/(ing), lead(er)/(ing), solid (end), strong, steadfast, value, increas(e)/(es)/(ingly), able, consisten(cy)/(t), important, mitigate, potential, goal(s), beyond, believe, help, challenges, grow(th), performance, pressure(s), further, remain(ed)/(s), achieved, remarkable, comparable, will, propositions, trends, key, improvement, encouraging, stabilizing, focus(ed), strateg(ic)/(y), reduc(e)/(tion), continu(e)/(ed)/(ing), target, support(ed), steps, towards, plans, see, opportunities, momentum, leveraging, deliberate and holistic reset, simplifying, ongoing, projects, initiative, uncertain(ty)/(ties), should, current, implies, anticipated, maintain(ing), commit(ted)/(ments), subject to, development, difference, ambition(s), would, risk(s), disruption, assessment, might, unless, assumption, may, yet, better, exposure, transition, effect, where, position(s), intention, transform(ed)/(ation(al)), strengthen, already, from time to time, reinforces, short-term, develop, considers or other similar words or expressions are typically used to identify forward looking statements.

Forward-looking statements are subject to risks, uncertainties and other factors that are difficult to predict and that may cause the actual results of Koninklijke Ahold Delhaize N.V. (the “Company”) to differ materially from future results expressed or implied by such forward-looking statements. Such factors include, but are not limited to, risks relating to the Company’s inability to successfully implement its strategy, manage the growth of its business or realize the anticipated benefits of acquisitions; risks relating to competition and pressure on profit margins in the food retail industry; the impact of economic conditions, including high levels of inflation, on consumer spending; changes in consumer expectations and preferences; turbulence in the global capital markets; political developments, natural disasters and pandemics; wars and geopolitical conflicts; climate change; energy supply issues; raw material scarcity and human rights developments in the supply chain; disruption of operations and other factors negatively affecting the Company’s suppliers; the unsuccessful operation of the Company’s franchised and affiliated stores; changes in supplier terms and the inability to pass on cost increases to prices; risks related to environmental, social and governance matters (including performance) and sustainable retailing; food safety issues resulting in product liability claims and adverse publicity; environmental liabilities associated with the properties that the Company owns or leases; competitive labor markets, changes in labor conditions and labor disruptions; increases in costs associated with the Company’s defined benefit pension plans; ransomware and other cybersecurity issues relating to the failure or breach of security of IT systems; the Company’s inability to successfully complete divestitures and the effect of contingent liabilities arising from completed divestitures; antitrust and similar legislation; unexpected outcomes in the Company’s legal proceedings; additional expenses or capital expenditures associated with compliance with federal, regional, state and local laws and regulations; unexpected outcomes with respect to tax audits; the impact of the Company’s outstanding financial debt; the Company’s ability to generate positive cash flows; fluctuation in interest rates; the change in reference interest rate; the impact of downgrades of the Company’s credit ratings and the associated increase in the Company’s cost of borrowing; exchange rate fluctuations; inherent limitations in the Company’s control systems; changes in accounting standards; inability to obtain effective levels of insurance coverage; adverse results arising from the Company’s claims against its self-insurance program; the Company’s inability to locate appropriate real estate or enter into real estate leases on commercially acceptable terms; and other factors discussed in the Company’s public filings and other disclosures.

Forward-looking statements reflect the current views of the Company’s management and assumptions based on information currently available to the Company’s management. Forward-looking statements speak only as of the date they are made, and the Company does not assume any obligation to update such statements, except as required by law.