We published our Annual Report 2024 on February 26, 2025

Find all info here

Investor Relations

Our Q3 numbers in a nutshell

with CFO Natalie Knight

Press release

Ahold Delhaize reports strong increase in Q3 sales and earnings, as our great local brands' value proposition continues to resonate well with customers

- With high inflation levels in the U.S. and Europe, our brands are focused on helping customers efficiently manage their spending. Supported by our €850 million Save for Our Customers cost savings program, our brands are working with suppliers to mitigate cost increases for customers, introducing more entry-priced products, expanding high-quality own-brand assortments and delivering personalized value through digital omnichannel loyalty programs.

- Q3 Group net sales increased 9.1% at constant exchange rates to €22.4 billion. At actual exchange rates, net sales grew 20.8%.

- Q3 comparable sales excluding gas accelerated in both regions compared to Q2, growing 8.2% in the U.S. and 7.4% in Europe. Increased market share in most of our brands' reflects strong loyalty to our locally tailored customer value propositions.

- Net consumer online sales increased 11.5% at constant exchange rates. Net consumer online sales in grocery increased 16.9% at constant exchange rates, as we continue to invest in new and innovative high-tech omnichannel solutions.

- Q3 underlying operating margin was 4.4%, in line with the prior year. Strong underlying U.S. margins and continued insurance gains from rising interest rates offset lower Europe margins which were impacted by rising energy costs and challenging economic environment.

- Q3 IFRS-reported operating income was €887 million and Q3 IFRS-reported diluted EPS was €0.59.

- Q3 diluted underlying EPS was €0.70, an increase of 31.6% over the prior year at actual rates.

- Based on Q3 results, we are increasing our full year EPS outlook. We now forecast low-double-digit 2022 diluted underlying EPS growth versus the prior mid-single-digit guidance. The 2022 free cash flow outlook remains at approximately €2.0 billion, with net capital expenditures expected to total approximately €2.5 billion.

- Ahold Delhaize announces a new €1 billion share buyback program to start at the beginning of 2023.

Zaandam, the Netherlands, November 9, 2022 – Ahold Delhaize, one of the world’s largest food retail groups and a leader in both supermarkets and e-commerce, reports third quarter results today.

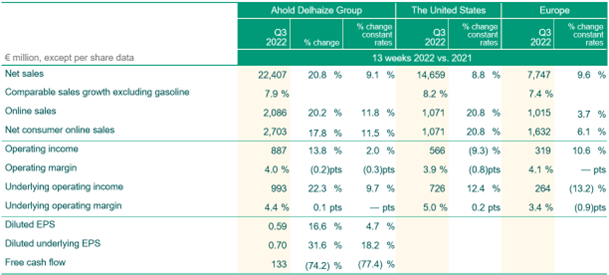

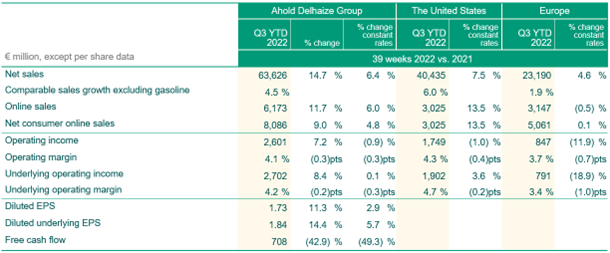

Summary of key financial data

Comments from Frans Muller, President and CEO of Ahold Delhaize

"Empowering customer choice by providing great value and easy access to affordable and healthy food options is at the center of the customer value proposition in all of our nineteen great local brands. Our positive market share development and resilient financial performance in Q3 highlights the trust customers continue to place in our brands. I am proud of these results and of our associates who consistently rise to meet the demands of these challenging times.

"Comparable store sales ex gas increased 7.9% in Q3, with an acceleration in growth rates in both the U.S. and Europe to 8.2% and 7.4%, respectively. The vast majority of our leading local brands continue to gain or maintain market share. Notably, during the quarter, our two biggest brands achieved significant milestones. Food Lion reached a decade of consecutive quarters of positive comparable sales growth, which is a remarkable achievement. Albert Heijn continues to win market share by focusing on providing value for customers in an increasingly challenging environment. This quarter included a new, traffic-generating ‘100 items under one euro’ campaign as well as an expansion to 1,600 ‘Prijsfavorieten’ (Price favorites), which include top-quality own-brand daily products at affordable prices. Albert Heijn Premium also passed the 600,000-member subscription mark this quarter.

"High inflation, increasing interest rates, slowing economic growth and the war in Ukraine are putting intense pressure on customers' household budgets. At the same time, retailers and suppliers alike are also facing rising costs of doing business. High energy prices, for example, are not just a cost headwind but are also disrupting supply chains, which are still fragile in many parts of the world. With a deep understanding of commodity prices, built through our extensive experience with own-brand products, our teams play an important role in the value chain and work hard on behalf of customers to ensure realistic pricing. In the face of increasing price pressures, it is everyone's job, across the value chain, to keep prices as low as possible for customers. To this end, we continue to engage diligently and proactively with partners, making clear choices on assortment when necessary. We are also adapting our organization and processes to rising costs by increasing efficiencies and mitigating costs wherever practical and possible.

"Building on strong sales growth, we delivered an underlying operating margin of 4.4% and diluted underlying EPS growth of 31.6% in Q3. Our results were again influenced by foreign exchange and interest rate changes as well as other items. In the U.S., our 5% underlying operating margin was positively impacted by 0.3 percentage points from the release of a provision on our self-insurance program. This resulted from, among other things, many years of strong efforts to improve workplace safety. In Europe, our Q3 underlying operating margin showed a slight improvement compared to Q2, despite a more pronounced impact from rising energy and utility costs. Since we last communicated in August, we have seen further increases in per-MwH prices, which will continue to weigh on our European margins in the coming quarters.

"On an IFRS-reported basis, our operating margin was 4.0%. There were two main impacts that led to these results. First, we took an impairment charge of €187 million on FreshDirect, which negatively impacted the reported IFRS U.S. operating margin, largely related to the broad based re-rating of sector valuations and reduced scope of that business that is now predominantly focused on the New York Tri-State area. And second, on an IFRS-reported basis, the European operating margin benefited from the release of a wage tax provision in Belgium amounting to €62 million.

"So, while we can't control external factors like energy prices, we have continued to work diligently on things that are under our control, and I am pleased we are making good progress. For example, at Stop & Shop, we continue to advance on our remodeling program, with over 40% of the store fleet now remodeled since 2018. An important focus area for Stop & Shop is New York City, where we announced a multi-year $140 million investment earlier this year. With the first five store remodels completed, we are encouraged to see all stores trending ahead of plan, with the sales lift driven by increased units and new customer transactions. In addition, the introduction of Stop & Shop's new Deal Lock savings program, which helps customers capture value by locking in a specific sales price for multiple weeks on both national and private brands, is delivering strong early chain-wide results. Delhaize Belgium also saw a material improvement in comparable store sales supported by the first full quarter of its Little Lions everyday low price program and enhancements to its SuperPlus initiative. At bol.com, net consumer online sales were up 5.6% in Q3, with a market share gain of well over one percentage point year to date. This was driven by double-digit growth in third-party partner network sales. And while the market is still challenging, the brand is well positioned to maximize the holiday season opportunity, supported by 'The Big Toy Book' and the logistical strength of its new distribution facility, which opened earlier this year.

"Taking a step back and looking at the big picture, I am equally encouraged about our progress on the key levers of our Leading Together strategy. Our omnichannel transformation is central to this strategy, driven by customers' desire to shop whenever and wherever they want. In Q3, net consumer online sales increased by 11.5%. Our online grocery sales were up 16.9% with strong growth in both regions as we continued to invest in new and innovative high-tech omnichannel solutions. Our Save for Our Customers cost savings program remains on track to produce savings of more than €850 million in 2022. These annual programs help our great local brands absorb cost increases to invest in better customer propositions and to keep shelf prices as low as possible. On another of our strategic initiatives, to generate €1 billion in complementary revenues by 2025, we also took important steps to bolster our digital advertising capabilities. We announced the acquisition of a minority stake in Belgian adtech company Adhese, which will provide an important part of the tech stack and third-party integration to help scale our capabilities and increase services for advertisers and publishers in Europe. In the U.S., Peapod Digital Labs announced plans to build an end-to-end, in-house retail media business, building on the existing AD Retail Media network. With this step, Ahold Delhaize USA creates a simplified way to engage omnichannel customers at the largest grocery retail group on the East Coast.

"We believe it is important to continue to make progress on elevating our Healthy and Sustainable strategy during these challenging times. It is clear from the science that more structural actions are needed to combat climate change, and we are encouraged to see that the current energy crisis is stimulating creative thinking and driving the transition to renewable energy. Our brands continue to work hard to bring meaningful initiatives to customers in stores and online. We are well on track to again deliver on key milestones related to growing our share of healthy sales, decreasing food waste and reducing the carbon emissions of our own operations. We believe that every step, no matter how big or small, counts. And our brands continue to show that it is not just about the numbers, there is real customer benefit as well. For example, Albert Heijn recently introduced its ‘Leftovers’ program to reduce food waste but also provide value to customers by enabling them to buy products approaching 'best by' or 'expiry' dates at lower prices. Our Albert brand in the Czech Republic became the first retailer to test a hydroponic system that grows herbs and leafy vegetables on the sales floor and also introduced a zero waste kitchen, turning leftover food from three stores into meals for over 100 associates.

"In conclusion, despite increasing macro-economic and geopolitical challenges, we continue to make important progress on delivering our strategy. Better-than-expected underlying U.S. results, foreign exchange benefits, and continued insurance gains from rising interest rates allow us to raise our full year diluted underlying EPS guidance to low-double-digit growth. Operational excellence, tight cost control and disciplined capital allocation continue to be important in these times. As such, we are working hard on a variety of initiatives across the company to maintain our industry-leading position of consistent and reliable performance, dependable cash flows and shareholder returns. This is a track record we are proud of, and, in light of our continued expectations of strong free cash flow generation going forward, we are announcing the continuation of our annual share buyback program in 2023. As always, striking the appropriate balance between supporting our associates, investing in our customers and local communities, prioritizing our digital and omnichannel transformation and playing our part in the transition to a healthy and sustainable food system will guide our decision making. Our proactive culture, our scale and our agility position us well – a testament to the strength of our company and our business model."

Q3 Financial highlights

Group highlights

Group net sales were €22.4 billion, an increase of 9.1% at constant exchange rates, and up 20.8% at actual exchange rates. Group net sales were driven by positive contributions from comparable sales growth excluding gasoline of 7.9%, foreign currency translation benefits, and higher gasoline sales. Q3 Group comparable sales benefited by approximately 0.2 percentage points from the net impact of calendar shifts and weather.

In Q3, Group net consumer online sales increased by 11.5% at constant exchange rates, led by a robust performance in the U.S. and a return to growth in Europe, where the difficult year-over-year comparisons that pressured first half results eased. Net consumer online sales in grocery increased 16.9% at constant exchange rates.

In Q3, Group underlying operating margin was 4.4%, consistent with Q3 2021 at constant exchange rates, reflecting strong cost savings and favorable insurance results, which helped offset higher labor, distribution and energy costs. In Q3, Group IFRS-reported operating income was €887 million, representing an IFRS-reported operating margin of 4.0%.

Underlying income from continuing operations was €696 million, up 27.3% in the quarter at actual rates. Ahold Delhaize's IFRS-reported net income in the quarter was €589 million. Diluted EPS was €0.59 and diluted underlying EPS was €0.70, up 31.6% at actual currency rates compared to last year's results and 18.2% at constant currency rates. In the quarter, 7.1 million own shares were purchased for €188 million, bringing the total year-to-date amount to €711 million through the first nine months.

U.S. highlights

U.S. net sales were €14.7 billion, an increase of 8.8% at constant exchange rates and up 27.4% at actual exchange rates. U.S. comparable sales excluding gasoline increased by 8.2%, benefiting by approximately 0.4 percentage points from the net impact of weather and calendar shifts. Food Lion continued to lead brand performance, celebrating 40 consecutive quarters of positive sales growth.

In Q3, online sales in the segment were up 20.8% in constant currency. This builds on top of 52.9% constant currency growth in the same quarter last year.

Underlying operating margin in the U.S. was 5.0%, up 0.2 percentage points at constant exchange rates from the prior year period. Q3 U.S. underlying operating margins benefited by 0.3 percentage points from a favorable reserve release impacted by various safety programs. In Q3, U.S. IFRS-reported operating margin was 3.9%, mainly impacted by an impairment charge in the amount of €187 million for FreshDirect.

Europe highlights

European net sales were €7.7 billion, an increase of 9.6% at constant exchange rates and 10.0% at actual exchange rates. These sales also benefited slightly from the 2021 acquisition of 38 stores from DEEN in the Netherlands, which was lapped late in Q3. Europe's comparable sales excluding gasoline increased by 7.4%, as shelf inflation accelerated in the quarter, and year-over-year comparisons eased versus a difficult first half of the year. Q3 Europe comparable sales were negatively impacted by approximately 0.1 percentage points from calendar shifts.

In Q3, net consumer online sales in the segment increased by 6.1%, following 20.1% growth in the same period last year. Net consumer online growth was driven in large part by strong grocery sales, where Ahold Delhaize's robust online solutions continue to serve consumers well. While non-food e-commerce market conditions in the Benelux remained soft, bol.com continued to gain market share, enabling it to generate positive net consumer online sales growth of 5.6% in the quarter, a sequential improvement versus the prior quarter. Bol.com's net consumer online sales from its more than 50,000 third-party sellers grew at 11% in Q3 and represented 59% of sales.

Underlying operating margin in Europe was 3.4%, down 0.9 percentage points from the prior year due to volume deleveraging and escalating energy and other cost pressures. Europe's Q3 IFRS-reported operating margin was 4.1%, positively impacted by the release of a wage tax provision in the amount of €62 million.

Outlook 2022

Despite challenging macro-economic operating conditions, our Q3 results provide us with the ability to again increase our full year EPS outlook. We now forecast low-double-digit 2022 diluted underlying EPS growth, versus the prior guidance of growth at a mid-single-digit range.

Ahold Delhaize's 2022 Group underlying operating margin is expected to be at least 4.0%, in line with the Company's historical profile. Management believes that the Company's brands continue to offer consumers a strong shopping proposition and are well-positioned to maintain profitability in the current inflationary environment. Ahold Delhaize's Save for Our Customers initiative is on track to deliver more than €850 million in savings in 2022, which is helping to offset cost pressures related to inflation and supply chain issues, along with the negative impact to margins from increased online sales penetration.

The 2022 free cash flow outlook remains at approximately €2.0 billion, with net capital expenditures expected to total approximately €2.5 billion. As labor and raw material costs remain high, we reiterate our commitment to exercise discipline in executing and phasing the timing of investments, in order to ensure hurdle rates and return on capital metrics are achieved.

In addition, Ahold Delhaize remains committed to its dividend policy and share buyback program, as previously stated. We are on track to increase our full-year dividend within our 40-50% payout range, in line with our policy, and we are executing our €1 billion share repurchase program in 2022 as planned. Ahold Delhaize also announces a new €1 billion share buyback program to start at the beginning of 20233.

- Excludes M&A.

- Calculated as a percentage of underlying income from continuing operations.

- Management remains committed to the share buyback and dividend program, but, given the uncertainty caused by the wider macro-economic consequences of the war in Ukraine and COVID-19, will continue to monitor macro-economic developments. The program is also subject to changes resulting from corporate activities, such as material M&A activity.

Cautionary notice

This communication contains information that qualifies as inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation.

This communication includes forward-looking statements. All statements other than statements of historical facts may be forward-looking statements. Words and expressions such as proposition, continue(s)/(d), resonate, resilient, manage, increasingly, believe, expectations, outlook, remains, adapting, challenging, focus, increasing, strategy, well positioned, plans, will, reiterate, risks, uncertainties, long-term, commitments, contingencies or other similar words or expressions are typically used to identify forward-looking statements.

Forward-looking statements are subject to risks, uncertainties and other factors that are difficult to predict and that may cause the actual results of Koninklijke Ahold Delhaize N.V. (the “Company”) to differ materially from future results expressed or implied by such forward-looking statements. Such factors include, but are not limited to, risks relating to the Company’s inability to successfully implement its strategy, manage the growth of its business or realize the anticipated benefits of acquisitions; risks relating to competition and pressure on profit margins in the food retail industry; the impact of economic conditions on consumer spending; turbulence in the global capital markets; political developments, natural disasters and pandemics; climate change; raw material scarcity and human rights developments in the supply chain; disruption of operations and other factors negatively affecting the Company’s suppliers; the unsuccessful operation of the Company’s franchised and affiliated stores; changes in supplier terms and the inability to pass on cost increases to prices; risks related to environmental, social and governance matters (including performance) and sustainable retailing; food safety issues resulting in product liability claims and adverse publicity; environmental liabilities associated with the properties that the Company owns or leases; competitive labor markets, changes in labor conditions and labor disruptions; increases in costs associated with the Company’s defined benefit pension plans; the failure or breach of security of IT systems; the Company’s inability to successfully complete divestitures and the effect of contingent liabilities arising from completed divestitures; antitrust and similar legislation; unexpected outcomes in the Company’s legal proceedings; additional expenses or capital expenditures associated with compliance with federal, regional, state and local laws and regulations; unexpected outcomes with respect to tax audits; the impact of the Company’s outstanding financial debt; the Company’s ability to generate positive cash flows; fluctuation in interest rates; the change in reference interest rate; the impact of downgrades of the Company’s credit ratings and the associated increase in the Company’s cost of borrowing; exchange rate fluctuations; inherent limitations in the Company’s control systems; changes in accounting standards; adverse results arising from the Company’s claims against its self-insurance program; the Company’s inability to locate appropriate real estate or enter into real estate leases on commercially acceptable terms; and other factors discussed in the Company’s public filings and other disclosures.

Forward-looking statements reflect the current views of the Company’s management and assumptions based on information currently available to the Company’s management. Forward-looking statements speak only as of the date they are made, and the Company does not assume any obligation to update such statements, except as required by law.