We published our Annual Report 2024 on February 26, 2025

Find all info here

Investor Relations

Our Q2 2021 numbers in a nutshell

with our CFO Natalie Knight

PRESS RELEASE

Ahold Delhaize reports firm Q2 results with higher two-year comparable sales growth rates**; raises full-year earnings and underlying operating margin guidance

- On a two-year comparable sales growth basis**, comparable sales excluding gas in the U.S. were up 19.1% and in Europe were up 12.6% in Q2 2021, a sequential acceleration versus growth in full year 2020 of 15.8% and 12.3%, respectively.

- Q2 Group net sales were €18.6 billion, up 3.0% at constant exchange rates, down 2.4% at actual exchange rates.

- In the U.S. and Europe, Q2 comparable sales excluding gas were (1.5)% and 2.4%, respectively.

- In Q2, net consumer online sales grew 35.8% at constant exchange rates, building on top of the significant 77.6% growth in Q2 2020.

- Q2 underlying operating margin was 4.5%; Q2 diluted underlying EPS was €0.53.

- Q2 IFRS-reported operating income was €817 million; Q2 IFRS-reported diluted EPS was €0.52.

- Raising 2021 underlying EPS and Group underlying operating margin outlook; expect underlying EPS to grow in the high-teen range versus 2019 and Group underlying operating margin to be approximately 4.3%.

- 2021 interim dividend is €0.43 compared to 2020 interim dividend of €0.50, based on the Group's interim dividend policy of 40% payout of first half underlying income per share from continuing operations.

** Two-year comparable sales growth is a stack of the comparable sales growth excluding gasoline in the current year period added to the comparable sales growth excluding gasoline in the prior year period. This measure may be helpful to improve the understanding of trends in periods that are affected by variations in prior year growth rates.

Zaandam, the Netherlands, August 11, 2021 – Ahold Delhaize, one of the world’s largest food retail groups and a leader in both supermarkets and e-commerce, reports second quarter results today.

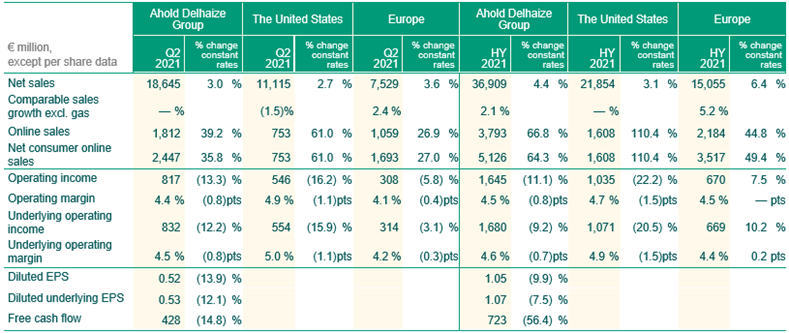

Summary of key financial data

Comments from Frans Muller, President and CEO of Ahold Delhaize

"We are pleased with our Q2 performance. During the quarter, associates in all our brands and businesses continued to work tirelessly in a rapidly shifting environment, marked by the gradual reopening of the economies across our markets. We remain grateful to them for their hard work and dedication to serving customers and communities. We would also like to express our support for everyone impacted by the recent flooding in the Netherlands and Belgium and fires in Greece, and are committed to serving these communities and our brands' associates during these difficult times. We are aware of the recent increases in infection rates in many of our markets and will continue to support COVID-19 vaccination efforts in the U.S. and provide help and assistance in all our communities. We remain on track to deliver on our pledge to contribute €20 million in charitable donations, spread evenly between the U.S. and Europe, during 2021. This is part of our broader spending for COVID-19-related care, which amounted to €84 million in the quarter. In Q2, our brands, together with suppliers, remained focused on fulfilling their vital role in society by maintaining food and product supplies to local communities.

"While communities across our markets reopened during Q2, food-at-home demand remained very resilient. Many of the habits formed by consumers during the COVID-19 pandemic in 2020 are proving sticky, aided by our initiatives to improve our omnichannel offerings for consumers. This drove Group net sales of €18.6 billion in the quarter and was exemplified by the acceleration in the Group two-year comparable sales stack in Q2 to 16.4%, versus growth of 14.4% in full year 2020. The two-year comparable sales stack growth rates were strong in both of our regions, but particularly in the U.S.

"While COVID-19 continues to create significant uncertainty, our Q2 results provide us with the confidence to raise our underlying EPS and underlying operating margin forecast for the full year. We also announced a 2021 interim dividend of €0.43 compared to the 2020 interim dividend of €0.50, in line with our dividend policy which is equal to 40% of the year-to-date underlying income per share from continuing operations. As previously communicated, expect to grow the full-year 2021 dividend year-over-year.

"We continue to be in a strategically stronger position in 2021 relative to the time before the COVID-19 pandemic began. Our investments in our online proposition continue to serve us well. In Q2, net consumer online sales continued to grow, coming on top of the very robust growth profile from the same quarter last year. During the quarter, we added 86 new click-and-collect locations in the U.S., continued to expand AH Compact (our no-fee delivery service in the Netherlands) to new markets, and doubled Albert Heijn's home delivery coverage in Belgium's Flanders region.

"Our "Save for Our Customers" program remains on track to produce savings of more than €750 million in 2021 and we continue to execute against our initiatives aimed at becoming a more efficient company beyond 2021. For example, after a successful pilot program, the U.S. businesses will scale up the use of artificial intelligence-enabled ‘exosuits’ to reduce fatigue and improve safety for associates in distribution centers. We also remain on schedule to achieve 65% self-distribution in the U.S. supply chain by year-end and 85% by 2022.

"We continue to make progress in elevating our Healthy and Sustainable strategy. We are proud to be one of the leading signers of the EU Code of Conduct for Responsible Food Business and Marketing Practices, as part of the European Green Deal, committed to shifting to a sustainable food system. As part of the pact, we have made commitments in the areas of healthier choices, product transparency, waste reduction and climate impact. In Europe, Romania has added the Nutri-Score nutritional navigation system to all of its own-brand ranges, joining Delhaize Belgium and our Serbian brands, which already utilize the Nutri-Score system. In the U.S., 52.4% of our Q2 sales are healthy, earning the Guiding Stars 1, 2, or 3 rating. This is in support of our company-wide ambition to raise sales of healthy own-brand products to 51% by the end of 2022; in 2020 we reached 49.8%."

Q2 Financial highlights

Group highlights

Group net sales were €18.6 billion, down 2.4% at actual exchange rates, but up 3.0% at constant exchange rates, impacted by unfavorable foreign exchange rate, acquisitions, a rebound in gasoline sales, and flat comparable sales growth excluding gasoline, cycling strong Q2 2020 results. Comparable sales were negatively impacted by approximately 0.3 percentage points from unfavorable calendar shifts in 2021. On a two-year comparable sales stack basis, growth for the Group of 16.4% in Q2 2021 was an acceleration from the 14.4% growth posted for the full year 2020, and consistent with the 16.4% growth from Q1 2021. In Q2, Group net consumer online sales grew 35.8% at constant exchange rates, aided by the FreshDirect acquisition.

In Q2, Group underlying operating margin was 4.5%, down 0.8 percentage points from the prior year at constant exchange rates, as margins lapped unusually high levels in the prior year due to COVID-19. Margins in 2020 benefited largely from higher operating leverage due to higher sales trends related to COVID-19. In Q2, Group IFRS-reported operating margin was 4.4%.

Underlying income from continuing operations was €551 million, down 20.6% in the quarter. Ahold Delhaize's IFRS-reported net income in the quarter was €540 million. Diluted EPS was €0.52 and diluted underlying EPS was €0.53, down 17.5% compared to last year's record Q2 results. Management believes that framing 2021 diluted underlying EPS growth relative to 2019 (prior to COVID-19) provides a helpful context for investors. Therefore, compared to Q2 2019, diluted underlying EPS in the quarter was up approximately 55%. In the quarter, 7.5 million own shares were purchased for €176 million, bringing the total amount to €488 million in the first half of the year.

U.S. highlights

U.S. net sales increased 2.7% at constant exchange rates, and declined 6.2% at actual exchange rates. U.S. comparable sales excluding gasoline declined 1.5%, as they were unfavorably impacted by the lapping of significant consumer stock-up activity related to COVID-19 in 2020, when comparable sales excluding gasoline grew 20.6% in the second quarter. On a two-year comparable sales stack basis for Q2 2021, growth was 19.1%, a sequential acceleration versus the 15.8% growth for the full year 2020. Brand performance continued to be led by Food Lion.

In Q2, online sales in the segment were up 61.0% in constant currency, driven by continued expansion of click-and-collect facilities and the FreshDirect acquisition. Excluding the FreshDirect acquisition, U.S. online sales grew 29.0% in constant currency, building on top of the significant 126.8% growth in the same quarter last year.

Underlying operating margin in the U.S. was 5.0%, down 1.1 percentage points from the prior year at constant exchange rates, as the prior year period benefited from higher operating leverage due to higher sales trends related to COVID-19 and, to a smaller extent, continued costs related to COVID-19. In Q2, U.S. IFRS-reported operating margin was 4.9%.

Europe highlights

European net sales grew 3.6% at constant exchange rates and 3.9% at actual exchange rates. Europe's comparable sales excluding gasoline grew 2.4%, despite lapping high comparable sales excluding gas of 10.2% in the same quarter last year. Q2 comparable sales were negatively impacted by approximately 0.7 percentage points from calendar shifts in 2021. On a two-year comparable sales stack basis for Q2 2021, growth was 12.6%, an acceleration compared to growth of 12.3% in 2020. The strong growth was led by performance at Albert Heijn, bol.com and in the Czech Republic.

In Q2, net consumer online sales in the segment were up 27.0%, which comes on top of 63.9% growth in the same period last year. At bol.com, net consumer sales grew by 24.2% in the quarter, which comes on top of 65.4% growth in Q2 2020. Bol.com's sales from third-party sellers grew 26% in the quarter, with nearly 47,000 merchant partners on the platform.

Underlying operating margin in Europe was 4.2%, down 0.3 percentage points from the prior year at constant exchange rates, as the prior year period benefited from higher operating leverage due to higher sales trends related to COVID-19 and to a smaller extent, continued costs related to COVID-19. In Q2, European IFRS-reported operating margin was 4.1%.

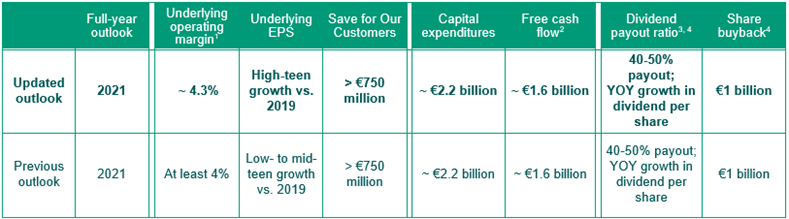

Outlook

While COVID-19 continues to create significant uncertainty for the remainder of 2021, our results in Q2 provide management the confidence to once again raise the underlying EPS growth outlook for 2021, and to raise the underlying operating margin outlook for 2021.

As previously reported, COVID-19, and to a lesser extent, a 53-week calendar, significantly distorted Ahold Delhaize's 2020 financial results. Lapping these effects will impact results in 2021, which returns to a 52-week calendar.

In 2021, the Group underlying operating margin outlook has been raised to approximately 4.3%, versus at least 4.0% previously, reflecting the strong margin performance over the first half of the year. The outlook continues to reflect the effects of the cost savings of over €750 million largely offsetting cost pressures related to COVID-19, that are expected to continue and the negative impact from increased online sales penetration.

The underlying EPS guidance has been raised and is now expected to grow in the high-teen range relative to 2019 earnings, versus low- to mid-teen growth previously. Management believes that framing 2021 underlying EPS guidance relative to 2019, which was prior to COVID-19 and also on a 52-week calendar, provides a helpful context for investors.

The free cash flow outlook is unchanged at approximately €1.6 billion. This puts the Company on track to reach €5.6 billion in cumulative free cash flow from 2019-2021 (averaging nearly €1.9 billion annually), which exceeds the Capital Markets Day 2018 target of €5.4 billion (averaging €1.8 billion annually). Capital expenditure is expected to be around €2.2 billion, and reflects the Company's higher investments in digital and omnichannel capabilities and for improvements related to recent M&A. In addition, Ahold Delhaize remains committed to its dividend policy and share buyback program in 2021, as previously stated. We expect to grow the full-year 2021 dividend year-over-year.

- No significant impact to underlying operating margin from returning to a 52-week calendar versus a 53-week calendar in 2020, though the return to a 52-week calendar will negatively impact net sales for the full year by 1.5-2.0%. Comparable sales growth will be presented on a comparable 52-week basis.

- Excludes M&A.

- Calculated as a percentage of underlying income from continuing operations.

- Management remains committed to the share buyback and dividend program, but given the uncertainty caused by COVID-19, will continue to monitor macroeconomic developments. The program is also subject to changes in corporate activities, such as material M&A activity.

Webcast

Cautionary notice

This communication contains information that qualifies as inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation.

This communication includes forward-looking statements. All statements other than statements of historical facts may be forward-looking statements. Words and expressions such as remain, would, committed, during, continue(s)/(d), on track, to be, strategically, aimed, becoming, beyond 2021, progress, uncertainty, outlook, expect(ed), believes, to grow, year-over-year, confidence, impact, to reach, target, risks, focus or other similar words or expressions are typically used to identify forward-looking statements.

Forward-looking statements are subject to risks, uncertainties and other factors that are difficult to predict and that may cause the actual results of Koninklijke Ahold Delhaize N.V. (the “Company”) to differ materially from future results expressed or implied by such forward-looking statements. Such factors include, but are not limited to, risks relating to the Company’s inability to successfully implement its strategy, manage the growth of its business or realize the anticipated benefits of acquisitions; risks relating to competition and pressure on profit margins in the food retail industry; the impact of economic conditions on consumer spending; turbulence in the global capital markets; political developments, natural disasters and pandemics; climate change; raw material scarcity and human rights developments in the supply chain; disruption of operations and other factors negatively affecting the Company’s suppliers; the unsuccessful operation of the Company’s franchised and affiliated stores; changes in supplier terms and the inability to pass on cost increases to prices; risks related to corporate responsibility and sustainable retailing; food safety issues resulting in product liability claims and adverse publicity; environmental liabilities associated with the properties that the Company owns or leases; competitive labor markets, changes in labor conditions and labor disruptions; increases in costs associated with the Company’s defined benefit pension plans; the failure or breach of security of IT systems; the Company’s inability to successfully complete divestitures and the effect of contingent liabilities arising from completed divestitures; antitrust and similar legislation; unexpected outcomes in the Company’s legal proceedings; additional expenses or capital expenditures associated with compliance with federal, regional, state and local laws and regulations; unexpected outcomes with respect to tax audits; the impact of the Company’s outstanding financial debt; the Company’s ability to generate positive cash flows; fluctuation in interest rates; the change in reference interest rate; the impact of downgrades of the Company’s credit ratings and the associated increase in the Company’s cost of borrowing; exchange rate fluctuations; inherent limitations in the Company’s control systems; changes in accounting standards; adverse results arising from the Company’s claims against its self-insurance program; the Company’s inability to locate appropriate real estate or enter into real estate leases on commercially acceptable terms; and other factors discussed in the Company’s public filings and other disclosures.

Forward-looking statements reflect the current views of the Company’s management and assumptions based on information currently available to the Company’s management. Forward-looking statements speak only as of the date they are made, and the Company does not assume any obligation to update such statements, except as required by law.